Enjoy 0% tax in the Union Country and the potential of lowering and even eliminating traditional tax burdens which will open the door to even greater opportunity. Avoiding heavy taxation in these new digital systems will enable the creation of digital assets and businesses with increased value for future generations.

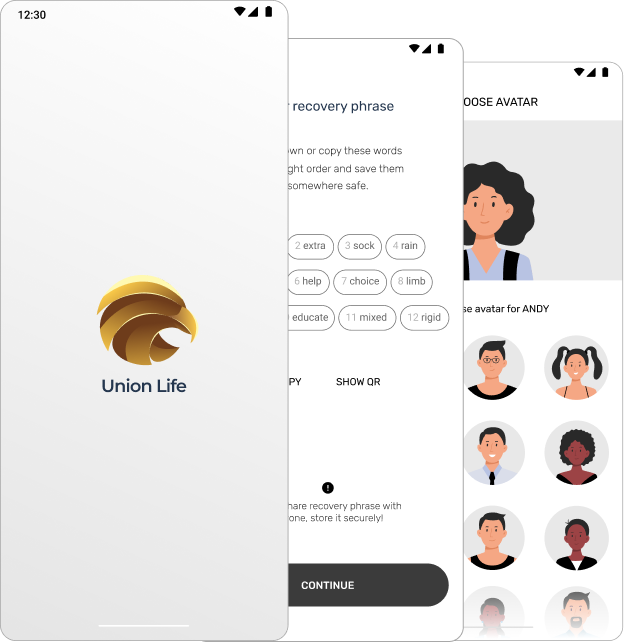

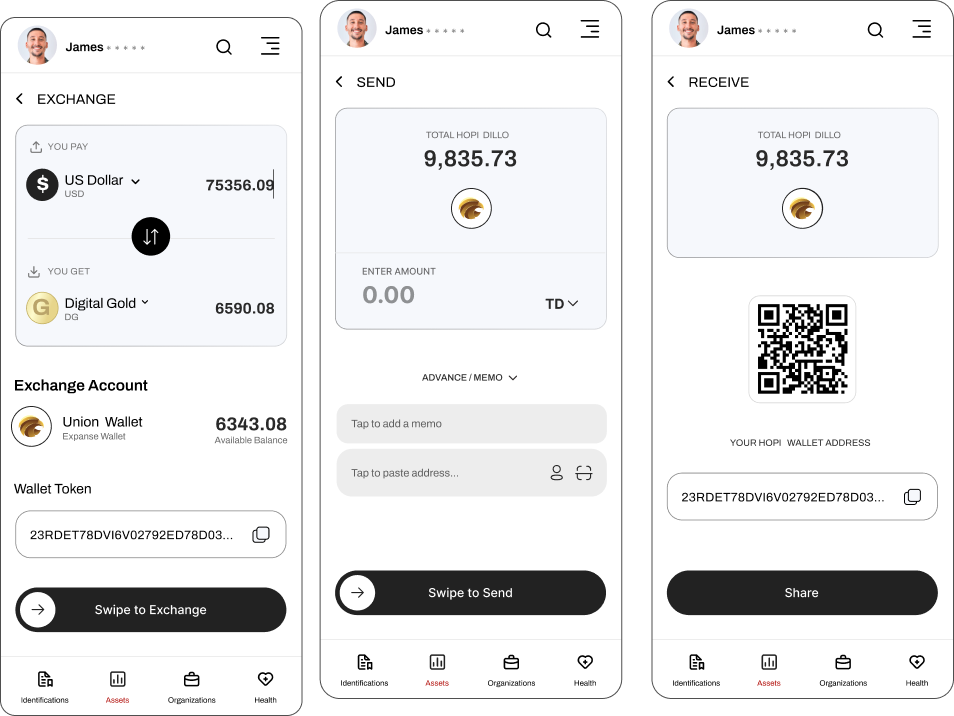

Union Country offers a new, safe, and convenient way to manage finances, and transfer money to family and friends, instantly. Digital Wallet handles all conversions including converting between fiat currencies and cryptocurrencies.

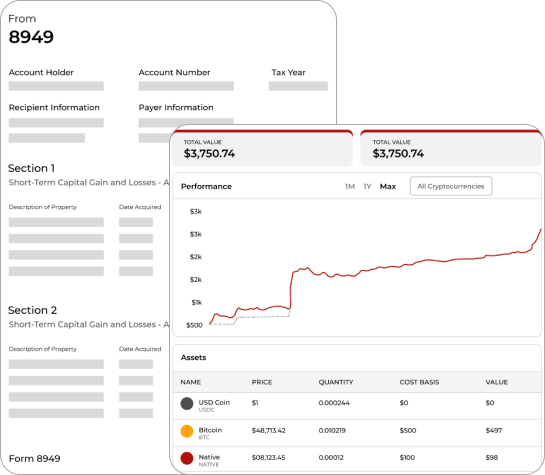

Help simplify and automate tax reporting duties for cryptocurrencies like Union Digital Dollar, Aloha, Clear, Ripple, Bitcoin, Ether and many other digital assets.

Automate your cryptocurrency tax forms and even filings by connecting your exchanges, wallets, DeFi protocols, NFTs, and more, then download completed tax forms with the click of a button.

The Union Country Tax Service Provider Network can also provide real-time insights into the value of your portfolio and a chance to optimize tax-loss harvesting strategies.

Form 8949 and other tax-form generation is available for all certified TaxBit Network Partners. For non-participating platforms, you may choose to subscribe to a premium plan, which includes tax forms from all platforms and many other premium features/functionalities.

Serving Digital investors across the entire digital assets ecosystem

Link all of your Digital data across 500+ sources to see the real-time tax impact of your trades. Then, you can generate your Forms related tax and income reports.

The most secure way to own, validate and prove your identity to anyone or any device from anywhere.